The majority of the best traders in the world use the Elliott waves concept. This is where you use confirmatory tools such as candlestick patterns. In the above example, we had a bullish engulfing candlestick pattern which also formed a second higher high.

Fibonacci ratios are mathematical ratios derived from the Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc.). After this, there was a long bearish correction, which finally ended, and the bullish trend went on as expected. Basically, fractals are structures that can be split into parts, each of which is a very similar copy of the whole. If the 2th wave has retraced 50% of wave one, 4th wave will probably retrace only 38.2% of wave three. Usually a combination includes a flat and a zigzag (or an additional three of some kind in a triple three).

5 Wave A, B, and C

In a bear market the dominant trend is downward, and the pattern is reversed—five waves down and three up. Motive waves always move with the trend, while corrective waves move against it. Elliott made detailed stock market predictions based on reliable characteristics he discovered in the wave patterns.

The key concepts of Elliott Wave Theory include wave patterns, impulse waves, corrective waves, Fibonacci ratios, and wave degrees. Wave patterns refer to the series of waves that make up a trend. Impulse waves move in the direction of the trend, while corrective waves move against the trend.

Ripple (XRP) Price Forecast: Counting on a Break Above $1? – BeInCrypto

Ripple (XRP) Price Forecast: Counting on a Break Above $1?.

Posted: Wed, 13 Sep 2023 10:15:00 GMT [source]

In this article you will learn more about how the Elliott Wave Theory works, what types of waves there are, and how to use Elliott waves in trading. One important quality of Elliott waves is that they are fractals. Much like seashells and snowflakes, Elliott waves could be further subdivided into smaller Elliot waves. But before we delve into the Elliott waves, you need to first understand what fractals are. In other words, Elliott came up with a system that enables traders to catch tops and bottoms. On the chart below you can see all characteristics of the regular flat.

In fact, we can apply three easily understood wave principles to a popular breakout strategy right now and watch how they improve market timing and profit production. We’ll look for specific Elliott Wave criteria after a major low appears and a financial instrument tests a key breakout level. Fibonacci Extension refers to the market moving with the primary trend into an areas of support and resistance at key Fibonacci levels where target profit is measured. Traders use the Fibonacci Extension to determine their target profit. One of the key weaknesses is that the practitioners can always blame their reading of the charts rather than weaknesses in the theory. Failing that, there is the open-ended interpretation of how long a wave takes to complete.

1 Elliott Wave 1 and wave 2

Stay on top of upcoming market-moving events with our customisable economic calendar. However, those two moves (5 and 3) can then be taken to form the ttm meaning finance part of a wider 5-3 wave. Traders can thus use the information above to determine the point of entry and profit target when entering into a trade.

- In September 2016, the index reached the historical high, and I spotted a visibly bullish wave pattern.

- The fact that we need to wait for waves 1 and 2 to form for the confirmation of the formation of an Elliott wave means we cannot trade all the waves.

- All the credit for this trading approach goes to a man named Ralph Nelson Elliott.

- By comparing the oscillator peaks, one can distinguish between a Wave 3 and

Wave 5 phase. - Another type of motive wave is the diagonal wave which, like all motive waves, consists of five sub-waves and moves in the direction of the trend.

The information provided by StockCharts.com, Inc. is not investment advice. The next section will give you some guidelines on labeling the wave-counts. The stock broke out into a 5th wave rally in mid-November and posted a swing high of 91.25, even higher than our Elliott target. Solid risk management then comes into play because it’s unnecessary to sell just because advancing price has reached a hypothetical ending point.

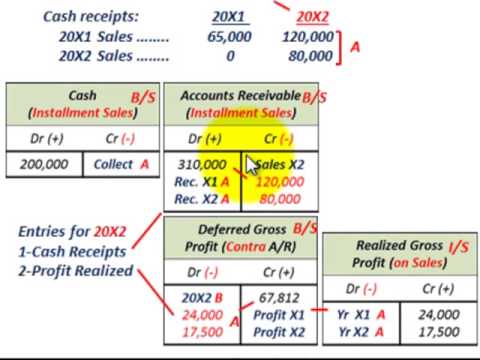

Elliott Wave International is the largest independent financial analysis and market forecasting firm whose market analysis and forecasting are based on Elliott’s model. Elliott found that corrective waves retrace impulse waves in Fibonacci proportions of 38%, 50%, and 62%. He also found that impulse waves within a larger impulse sequence relate to each other in Fibonacci proportion. Corrective wave patterns unfold in forms known as zigzags, flats, or triangles. In turn these corrective patterns can come together to form more complex corrections. Similarly, a triangular corrective pattern is formed usually in wave 4, but very rarely in wave 2, and is the indication of the end of a correction.

Business Model Acknowledgment: The company is a prop trading firm and does not onboard retail clients

Wave patterns can be open to interpretation, and different analysts may identify different wave counts. Fibonacci time zones are used to identify potential time targets for a wave. These time zones are derived from the Fibonacci sequence and are used to identify potential turning points in the market. While Elliott Wave Theory has its supporters, it is also criticized by some traders and analysts for its subjective nature and the potential for interpretation bias. He believes that, if you can correctly identify the repeating patterns in prices, you can predict where the price will go (or not go) next. By analyzing closely 75 years’ worth of stock data, Elliott discovered that stock markets, thought to behave in a somewhat chaotic manner, actually didn’t.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. The most commonly used Fibonacci time zones are 38.2%, 50%, and 61.8% of the time taken for the previous wave to complete. Fibonacci relationships are an essential component of the Elliott Wave Theory.

Risk Management and Trading Strategies

These three elements will go a long way in helping us to draw, validate and trade the Elliott wave forex method. His invention was so perfect that he came up with 6 cardinal rules to help traders in identifying and validating the Elliott waves. The first phase of the Elliott wave theory trading principle consists of 5 waves. Waves 2 and 4 move against the main trend and are known as the Corrective waves. According to this theory, a trending market moves in a 5-3 wave pattern.

A number is assigned to each wave in the Elliott wave which follows a unique concept. As you might notice, https://1investing.in/ involves counting of the waves and uses Fibonacci retracement levels. This need to quickly assess the pattern in complex markets is what makes the theory so challenging to master. In this article we will first cover the Elliott wave basics and structure.

We do not say that the method is easy to learn and apply, but if you work and study hard, we promise it will become your favorite. Ralph Nelson Elliott was born in Marysville, Kansas on July 28th 1871. During the greater part of his life he worked as an accountant for several railroad companies in Central America and Mexico. Elliott was forced to retire early, due to debilitating intestinal illness he cought during his time in Central America. In order to keep his mind occupied, Elliott began studying the American stock market. Somewhere in the mid 1930s he discovered, that the price action of stocks is not random or chaotic, but patterned.

The next chart below shows the Elliott wave analysis in the simplest form. Based on the counting of waves, each wave is given a distinct naming convention as shown below. Now that we have tackled a brief overview, let’s dig into the principles of the theory and key retracement levels which categorize the waves.

Waves A and C are made up of five waves characterized by ((i)), ((ii)), ((iii)), ((iv)), and ((v)). On the other hand, Wave B is made up of three waves identified by ((a)), ((b)), and ((c)). Elliott Wave degree is an Elliott Wave language to identify cycles so that analyst can identify position of a wave within overall progress of the market. Elliott acknowledged 9 degrees of waves from the Grand Super Cycle degree which is usually found in weekly and monthly time frame to Subminuette degree which is found in the hourly time frame.

His theory of pattern recognition argues that market trends unfold in five waves when traveling in the direction of a primary impulse and 3 waves when opposing that impulse. This theory further stipulates that each wave will subdivide into three waves towards the trend and two against it. Finally, it explains a fractal market in which each wave churns out similar patterns within progressively lower and higher time frames. Elliott’s market model relies heavily on looking at price charts. The Elliott Wave Theory suggests that the stock prices move continuously up and down in the same pattern known as waves that are formed by the traders’ psychology.

Trade Dork Ignites a Trading Revolution with Dorkblog – Get Ready … – Digital Journal

Trade Dork Ignites a Trading Revolution with Dorkblog – Get Ready ….

Posted: Tue, 12 Sep 2023 18:45:55 GMT [source]

Corrective waves, called diagonal waves, consist of three, or a combination of three sub-waves that make net movement in the direction opposite to the trend of the next-largest degree. As you can see from the patterns pictured above, five waves do not always travel net upward, and three waves do not always travel net downward. When the larger-degree trend is down, for instance, so is the five-wave sequence. An impulse-wave formation, followed by a corrective wave, forms an Elliott wave degree consisting of trends and countertrends. Ralph Nelson Elliott developed the Elliott Wave Theory in the 1930s.

By studying 75 years of past market data, Elliott noticed that prices make five swings in the direction of the larger trend and only three swings against it. If the trend is moving up, there are five waves in the upward direction and three downwards. If the trend is moving south, the Elliott Wave cycle is upside down – five down, three up. Due to the fact that Elliott wave analysis combines counting of waves and market psychology traders will find this approach to be quite unique. If you strip away the complex terminologies that comes with Elliott wave trading, you will find that there is a stark similarity to the Dow theory of trends. The use of corrective waves highlights the potential cross-study of Fibonacci retracements.

Three of them are motive and move in the direction of the main trend while the other are corrective waves. Since the Elliott Wave theory is a law of nature, they are still applicable today with the same success rate. If you have been following everything till now, you have probably noticed the Wave Principle’s ability to forecast reversals. While the majority of traders and investors simply rely on the trend, Elliotticians have an edge of being able to prepare for a probable change in the trend’s direction.

An impulse wave, which net travels in the same direction as the larger trend, always shows five waves in its pattern. A corrective wave, on the other hand, net travels in the opposite direction of the main trend. On a smaller scale, within each of the impulsive waves, five waves again can be found. This next pattern repeats itself ad infinitum at ever-smaller scales. An impulse wave is one of the two wave patterns defined by Ralph Nelson Elliott.

Elliott discovered stock index price patterns were structured in the same way. He then began to look at how these repeating patterns could be used as predictive indicators of future market moves. With the help of this Elliott wave theory, traders can forecast market trends by identifying extremes in prices and investor psychology.

Wave C goes back below the end of wave A to bring the whole correction to an end. The good thing is that 90% ot the impulsive waves look like on the above-shown charts. The first alternative is the truncated fifth wave or simply “truncation”. Each wave of the five-wave sequence is constructed of smaller waves. Furthermore, he found out that this 5-3 Elliott Wave cycle can be found on all degrees of trend. It stays the same, regardless of whether we are looking at a yearly or a five-minute chart.